Sales Channel Strategy

Relentless competition in today’s markets is driving companies to re-invent their sales channel strategies, in order to ensure that they are within arm’s reach of customers, wherever they are and whenever required. Winning companies understand how to align their supply chain structure and exploit today’s technologies effectively in support of the selected business strategy. Above all, these companies have put in place a business architecture, (including channel partners as appropriate) which delivers operational flexibility and speed of implementation. As part of our range of marketing solutions, we help companies determine how to strategically use marketing to reach their target customers. In this article the following questions will be addressed:

- what is a business architecture and why is it important?

- what can we learn from today’s leading edge practices in consumer goods channels?

- are similar trends evident in the electronics and high technology sectors?

- what are the implications of new computer technology for sales channel strategy?

- are industrial companies exploiting sales channel strategy effectively?

Business Architecture

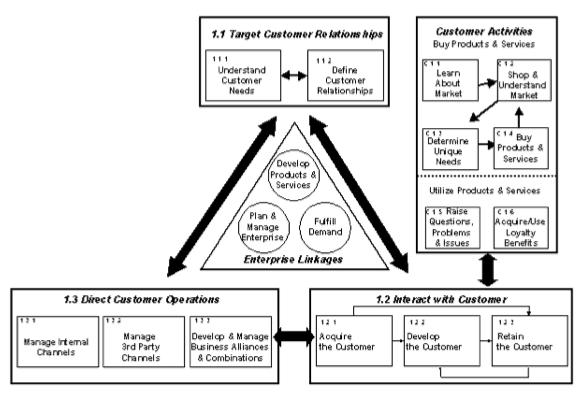

A working definition of business architecture would include the ownership structure, operational processes, channel structure and technology infrastructure of the whole supply chain. The design of these factors is a crucial influence on:

- customer satisfaction and loyalty

- the operational performance of the supply chain

- financial returns to the owners

- speed of reconfiguration as required to maintain support for the business strategy.

Innovative companies have understood and exploited these ideas for many years. In fashion, Benetton was an early exponent of “quick response” and leveraged its channel ownership structure through a cleverly designed supply chain that included small subcontract manufacturers and franchised retail outlets. Start-up companies who built global businesses very quickly selling hard goods through the retail channel, such as Packard Bell with PCs, took advantage of cross-ownership structures within the supplier base and established close relationships with key retailers. Caterpillar, which today dominates the market for heavy construction equipment, has maintained this enviable position through the closest possible co-operation with its franchised dealers.

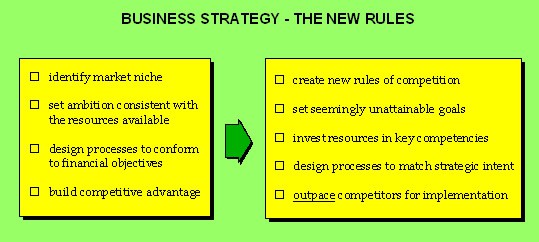

The creation of a powerful business architecture may be one of the few sustainable sources of competitive advantage: technical innovations can be copied or superseded quickly, but harder to match is the binding together towards common goals of participants in the value chain.

Consumer Goods Channel Development

Five years ago, less than 0.5% of grocery retailing went through the petrol stations: today the figure is well over 5%, a massive annual market in its own right. Brand loyalty can turn Virgin into a successful direct supplier of financial services and help move Wall-Mart into the mainstream of personal banking. Industry leaders have learned to target a total share of end customer spending, not just their historical share with historical product ranges.

This is achieved using a portfolio of different channels, including the formation of new partnerships and exploitation of new technologies. Why is all of this important? Of the top 10 US food producers in 1980, only two are still in this league. The same ratio applies to the computer industry and the banking sector. It seems that formerly stable sectors are acquiring the characteristics of the fashion industry!

Dancing Giants

What lessons are there to be learned in the high technology sector that is subject to convergence of many products and services, with respect to content, consumer electronics, computers and communications? This has given rise not only to notoriously short product life cycles, but also to compelling opportunities and awe-inspiring risks for the participants.

What lessons are there to be learned in the high technology sector that is subject to convergence of many products and services, with respect to content, consumer electronics, computers and communications? This has given rise not only to notoriously short product life cycles, but also to compelling opportunities and awe-inspiring risks for the participants.

Virtually daily there are announcements of acquisitions, mergers, alliances and partnering activity, with clusters around different technology models, as companies take part in a frenetic global mating dance.

Though price competition is brutal, history shows that segment entrants with new products often present a more dangerous form of competition. For example:

- Apple is no longer about a computer; it’s a music and a phone device

- traditional PC makers Compaq and Dell compete with servers and workstations, threatening Sun

- Sun itself is pushing into the territory traditionally owned by computer mainframe and telecommunications equipment manufacturers

What implications for sales channel strategy have been observed?

Go Direct …?

Leaders in supply chain design and execution are exploiting electronic commerce via intranets and the Internet as a whole, in order to get closer to their suppliers and customers. Results can be measured in terms of:

- better customer service

- improved supplier co-ordination

- more effective product data management

- reduced administrative cost, greater transaction accuracy and better inventory tracking

- increased product “velocity” through the channel and reduced working capital.

Some companies have gone further in an attempt to redefine traditional ways of doing business. Ciscos in electronics, as well as several automotive companies use the internet to allow end-customers to locate, configure and order the desired product without the intervention of salespeople.

Gathering meaningful end-customer information which enables the company to develop its “one-to-one marketing” capability is the holy grail in the scramble for improved customer loyalty. Ford estimates that each one-point gain in customer loyalty is worth $100m in profit. In the US, a survey by the Strategic Planning Institute showed that companies rated highly by their customers for service are able to charge on average 9% more than those who are poorly rated.

Or Indirect?

Consumer-direct strategies such as those described above represent little short of a revolution in business practices for many industry segments. Today’s new technologies for communications, Internet applications and customer data management provide a tremendous imperative for many companies to redesign their key business processes. But to do this without thinking through the structure of the sales channel may be courting disaster!

In many important segments the intermediary (dealer or reseller) still has a role to play: but this role will have to be developed in order to strengthen the partnership with the original equipment manufacturer. The goal is a win-win relationship that can:

- increase customer satisfaction and loyalty

- deliver differentiated levels of service depending on customer segment

- increase flexibility and agility to cope with business cycles

- increase profitability and reduce capital employed for all the channel participants

- feed back customer intelligence to the manufacturer.

IBM, HP and Compaq operate channel configuration projects, whereby authorized (corporate) resellers configure base products to customer order, often within hours. Alternatively, the customer order taken by the reseller may be built by the manufacturer and shipped direct, within 48 hours for mainstream models. Estimates of the savings that are made through reduced inventory, price protection, returns, warranties, and freight cost vary from 10 to 15 percent. This would enable these companies to retain an indirect selling model where required, yet to reduce prices and compete more effectively with the established direct sellers such as Dell.

The Missing Links

Whatever the industry segment, it is vital to build a clear vision for the target business architecture, including enhanced channel relationships, integrated supply chain, appropriate supporting technologies and a quantified financial return for the channel participants.

Unfortunately, the fact is that most demand processes are not set up to sense or anticipate customer requirements for solutions that deliver value and convenience. Few companies have the quantitative information that would enable them to answer important questions such as:

- which customer service parameters (such as order fill rate, delivery reliability, order turnaround time, local added-value services) are the most important drivers of customer loyalty?

- how would market share and pricing be affected by an improvement in the level of service or extension of product range for key customer segments?

- what level of performance against competitors would be required to “motivate” desired customer behavior and what new competencies and/or technologies are required?

- what would be the financial payback for improved customer loyalty, how does the channel need to develop and which participants would benefit?

- what is the “cost-to-serve” at this level of performance and what investments would be required for implementation?

In today’s uncertain environment, stressed by the impact of new technologies, competitive edge is gained by means of a thorough understanding of the cause and effect relationships between customer service, operational integration effectiveness, sales channel design and financial returns for the participants. In some cases this will represent the difference between success and failure in the coming years.

Contact SPIRE Express today for more information on how we can help you develop an effective architecture for your business.